Sector’s financial position ‘critical’, says new report

Operating losses continue to grow for the residential aged care sector, according to the latest industry report.

Operating losses continue to grow for the residential aged care sector, according to the latest industry report.

StewartBrown’s Aged Care Financial Performance Survey Report for the second half of 2022 shows the average operating results for aged care homes across Australia was a loss of $15.98 per bed per day – up from $10.31 the previous year.

The survey – which crunches data from 1,138 aged care homes – confirms the ongoing economic decline of the sector, with many providers “at a critical financial sustainability position,” reads the 28-page report.

In all, 63 per cent of aged care homes operated at a loss during the last six months of 2022.

Workforce shortages continue to drain profit margins as providers draft in increased numbers of agency staff. For the period, agency staff represented $15.33 per bed per day – an increase of $8.81 compared to December 2021 ($6.52).

A decline in occupancy levels – 90.8 per cent of available beds compared to 91.5 per cent the previous year – further erodes financial performance for providers.

Considering the sector has endured five years of successive financial losses, the authors seem surprised that there hasn’t been “greater provider failure”.

Indeed, the sector has seen a number of acquisitions over that period – including several major mergers – “which seem contradictory to the declining financial performance.”

Home care

Staffing remains a key concern in the home care sector and this, coupled with an overly complex regulatory environment, has seen financial performance declining.

Analysing data from 66,703 home care packages, the StewartBrown survey finds the current operating result has decreased to a surplus of $2.54 per client per day, compared to $4.51 the previous year.

The financial performance of the home care sector has idled over the past four financial years, note the authors, who say, “such a financial return is not adequate based on the investment required and business risk to provide these essential services to the elderly in a domestic home setting.”

Under utilisation of services remains an issue for the sector with unspent funds for the period reaching $11,241 for every home care client.

Major reasons for this include flaws in the current funding model and staffing shortages. “Increased utilisation is required to fully cover the fixed costs, encourage investment in technology and innovation and therefore improve financial performance,” say the authors.

Meanwhile, the home care sector continues to operate in a “policy void” of uncertainty, say the report’s authors.

This is due to a lack of clarity over the new home care model – which is due to kick-in from 1 July 2024 – and its potential implications for providers and clients alike.

As a result, say the authors, many providers are experiencing “a stagnation of innovation”.

Conclusions and recommendations

As in previous financial performance reports, StewartBrown recommends that – to produce profitability – sector stakeholders engage in solutions beyond government funding issues.

“Ultimately,” say the authors, “this will come down to requiring a greater level of consumer co-contribution in funding aged care,” particularly for indirect care (everyday living) and accommodation services – a proposal that has the backing of providers.

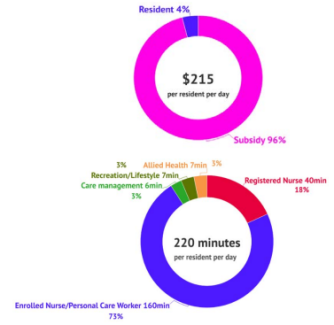

Currently, the resident pays just 4 per cent toward indirect care – which costs an average of $215 per day – with the taxpayer subsidising the remaining 96 per cent.

The report’s authors are also suggesting amendments to the aged care means test. They support a recommendation of the Tune Review which called for the full value of an owner’s home be included in the means test for residential care – currently capped at just below $200,000 for the primary property.

Workforce shortages remain the biggest challenge facing the sector. And while the 15 per cent wage increase from 30 June is a positive step, the report’s authors question “whether this increase is sufficient on its own to attract additional staff.” Other incentives and benefits may be required, they say.

Regarding the Australian National Aged Care Classification, the authors are calling on the Independent Hospital and Aged Care Pricing Authority – which costs the price of care – “to ensure that the funding matches the input costs, and that inflation and wage increases are appropriately covered.”

“To be successfully implemented,” say the report’s authors, “these reforms will require unilateral support from all stakeholders and increased understanding of the financial aspects of providing aged care services.”

Comment on the story below. Follow Australian Ageing Agenda on LinkedIn, X (Twitter) and Facebook, sign up to our twice-weekly newsletter and subscribe to our premium content or AAA magazine for the complete aged care picture.